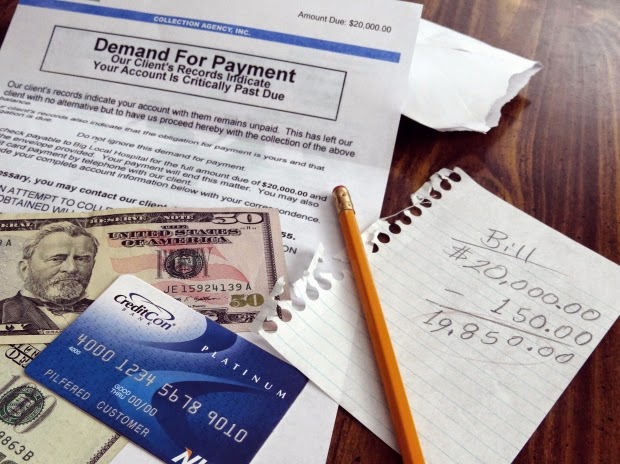

College For Free

College is obscenely expensive and with a nearly 50% unemployment

rate among graduates, is it worth it? College debt tops ONE TRILLION DOLLARS.

That is more than American’s house/car/credit card debt combined.

College costs

have increased 1000% in my lifetime. And bankruptcy isn’t an option with

college debt. Where you go, the debt follows.

Luke was a high school graduate without finances for college,

so he decided to volunteer for an African mission—digging wells and running

food shelters for displaced refugees.

He didn’t make any money, but he learned

management skills, first-aid on the fly, how to fix a generator with altered

parts, and gaining a worldview that living in a tin hut provides.

Arriving back in the states, he still couldn’t afford

college, but he found a job stocking grocery shelves. Rather than settling in

with the reasonable salary and benefits, he used his free time to take online

college courses.

Why pay for what you can get for free? Luke tapped into

economics courses offered through Stanford University. He took an MIT financial

theory course offered through iTunes University. That was just the beginning.

He studied during breaks, after work and every weekend. It didn’t take long to acquire quite

a resume of coursework.

Scrolling through the offerings, Luke determined his next

step—studying law. He finished the law courses offered by

top-name universities, without paying a dime of tuition. It was exhausting, but

his college-counterparts faced years repaying law school debt.

Luke’s only investment was time. And his efforts hadn’t gone

unnoticed. He was offered a management position at the grocery store. That was

just the beginning.

Luke knows that when you build it yourself, you know how it

all works. He used his self-made college degree and parlayed it into a

successful career.

Now he routinely travels back to Africa—he loves giving back

in the place where it all started. Need college? Look online. Luke knows that if

you work for it; it will work for you.